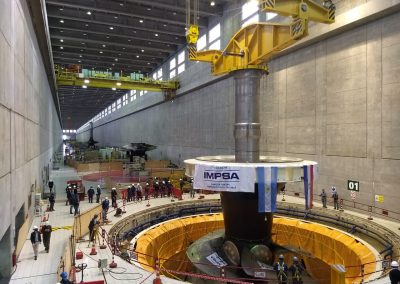

With the support of public and private entities, both international (Inter-American Development Bank, Export Development Canada, Andean Development Corporation and international bondholders, among others) and national (Banco de la Nación Argentina, BICE, bondholders, among others) the proposal to rebuild the capital structure presented by IMPSA in its APE Offer, obtained a majority acceptance by creditors, far exceeding the legal minimums required for the approval of the APE. “We are grateful for the support of creditors and we hope for this next stage to reinforce the position that IMPSA occupied for decades at the forefront of world technological development in the field of hydroelectric, nuclear and other renewable energies. We are facing a great opportunity to continue producing Argentine technology that can be exported to the world and to consolidate our role as a benchmark for the activity at a global level” said Juan Carlos Fernández, CEO of IMPSA. For this new stage, IMPSA, the leading technology company in power generation equipment, has taken a very important step that will allow it to, once again, conquer the local and foreign markets, as it has done throughout its history, while making possible the payment of the sums owed to all its creditors, without capital deductions and on reasonable terms. Despite the limitations of the pandemic, IMPSA is executing contracts for hydroelectric, nuclear, wind and solar plants as well as equipment for the oil and gas industry. In turn, it is providing services to power generation plants throughout the country. Its first-rate international technological development, added to its new economic-financial situation, will allow the company to face with greater dynamism projects in different regions of the world, mainly in Asia, Africa and the Americas.

With the support of the creditors that represent 98% of the amount of the computable debt for voting purposes, IMPSA achieves the approval of the exchange of the existing debt for new Negotiable Obligations with Public and Private Offer, a new International Bond and new Loans. The agreement includes a re profiling of the debt without a capital reduction. (Mendoza, November 25th, 2020).